south carolina inheritance tax 2020

If the total amount of taxes due is. Check the status of your South Carolina tax refund.

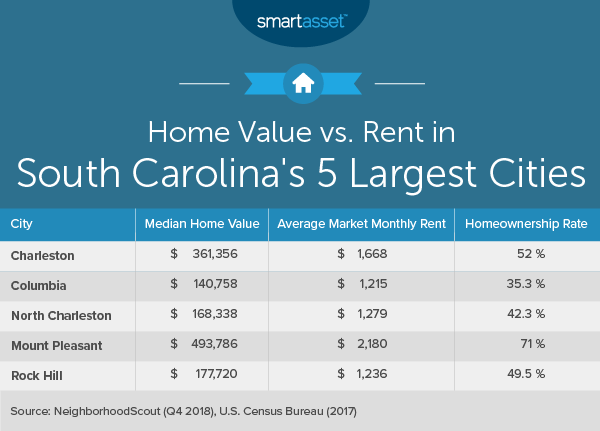

The True Cost Of Living In South Carolina

Tax was permanently repealed in 2014 with repeal of all of SDCL 10-40A effective July 1 2014.

. The SC Department of Revenue publishes online tutorials and sponsors tax seminars and workshops throughout the. However the Palmetto States income tax is between 0 and 7 the 13th-highest in the country. In addition gifts to spouses who are not US.

South Carolina accepts the adjustments exemptions and deductions allowed on your federal tax return with few modifications. 541 which increased the Vermont estate tax exemption to 4250000 in 2020 and. Restaurants In Matthews Nc That Deliver.

That way a joint bank account will automatically pass. License fees will not be collected March 1 2021. The federal estate tax is levied on a propertys taxable part before the heir transfers the assets.

2020 INSTRUCTIONS PROPERTY CASUALTY TAX RETURNS. However according to some inheritance laws of South Carolina not all the deceased persons property may be considered as a part of the estate. A federal estate tax is in effect as of 2021 but the exemption is significant.

1158 million in 2020 the estate is subject to an estate tax. However you are. There are no inheritance or estate taxes in South Carolina.

In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million. Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. Restaurants In Erie County Lawsuit.

Writer must be of sound mind and body. On June 18 2019 Vermont enacted H. South Carolina Estate Tax 2020.

State Inheritance Taxes. South Carolina also does not impose an Estate Tax which is a tax taken from the deceaseds estate soon after the loved one has passed. Manage Your South Carolina Tax Accounts Online.

And in. Inheritance taxes which are calculated based on who inherits the estate as opposed to the overall value of the estate are currently collected in the states of Iowa Kentucky Maryland Nebraska New Jersey and PennsylvaniaNotice that Maryland and New Jersey collect both state estate taxes and inheritance taxes. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need.

Opry Mills Breakfast Restaurants. Still individuals who are gifted more than 15000 in one calendar year are subject to the federal gift tax. Iowa has a separate inheritance tax on transfers to others than lineal ascendants and descendants.

Determine whether you are responsible for paying federal estate tax on your inheritance. This threshold changes often but in 2020 the threshold was 1158 million. Additionally after deductions and credits estate tax is only imposed on the value of an estate that exceeds the exemption.

Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021. Will must be signed by the writer and two. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. It has a progressive scale of up to 40. Does South Carolina Have an Inheritance Tax or Estate Tax.

Schedule 01 - South Carolina Taxes and Obligations All Insurers 1. Not every state imposes the Inheritance Tax and South Carolina is one of many that does not. Estate taxes apply to the estate itself not the inheritor.

Individual income tax rates. Securely file pay and register most South Carolina taxes using the SCDORs free online tax portal MyDORWAY. In January 2013 Congress set the estate tax exemption at 5000000 for decedents dying in 2011 and indexed it to inflation.

Contrary to what many people think federal estate taxes do not apply to the. Are Dental Implants Tax Deductible In Ireland. 4 The federal government does not impose an inheritance tax.

Creating a will is oftentimes the first step that South Carolina residents must take in estate planning. A married couple is exempt from paying estate taxes if they do not have children. If an inherited estate is valued.

For decedents dying in 2013 the figure was 5250000 and the 2014 figure is 5340000. Like estate taxes and inheritance taxes South Carolina also does not have a gift tax. If they are married the spouse may be able to leave everything to each other without paying any estate tax.

The District of Columbia moved in the. Your federal taxable income is the starting point in determining your state income tax liability. It is one of the 38 states that does not have either inheritance or estate tax.

Writer must be at least 18 years. 117 million increasing to 1206 million for deaths that occur in 2022. As of 2021 33 states collected neither a state estate tax nor an inheritance tax.

States Without Death Taxes. Ad From Fisher Investments 40 years managing money and helping thousands of families. Does South Carolina Have an Inheritance Tax or Estate Tax.

South Carolina has a simplified income tax structure which follows the federal income tax laws. South Carolina has no estate tax for decedents dying on or after January 1 2005. Federal estate tax The federal estate tax is applied if an inherited estate is more than 1158 million in 2020.

You are liable for estate taxes only if the estate itself did not set aside money for this purpose and only if the value of the estate exceeds the taxable threshold. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. The amount on Line 0199 is what you should remit for payment.

The requirements for a valid will change from state to state but are pretty straightforward in South Carolina.

Moving To South Carolina 12 Reasons You Ll Love Living In Sc

A Guide To South Carolina Inheritance Laws

South Carolina Paycheck Calculator Smartasset

South Carolina Funeral Burial Insurance Lincoln Heritage

Ultimate Guide To Understanding South Carolina Property Taxes

Cost Of Living In South Carolina Smartasset

South Carolina Retirement Tax Friendliness Smartasset

Real Estate Property Tax Data Charleston County Economic Development

South Carolina Estate Tax Everything You Need To Know Smartasset

South Carolina Military And Veterans Benefits The Official Army Benefits Website

South Carolina Income Tax Brackets 2020

South Carolina Estate Tax Everything You Need To Know Smartasset

Revealed Living In South Carolina Vs North Carolina This May Surprise You Youtube

South Carolina Estate Tax Everything You Need To Know Smartasset

South Carolina Israel Cooperation

A Guide To South Carolina Inheritance Laws

South Carolina Vs North Carolina Which Is The Better State Of The Carolinas